China’s $1.6 Trillion Defaulted Debt

An Interview with Jonna Bianco of the American Bondholders Foundation

by Jerry Gordon and Rod Reuven Dovid Bryant (June 2020)

There is a burgeoning economic cold war between China and the US during the COVID-19 Pandemic. It is triggered by accusations of a coverup of the breakout of the deadly virus of nearly 100,000 fatalities and massive negative economic impacts on employment and growth. Add to that the X-Ping regime is launching a national security law that would end the ‘One Country, Two System’ status of Hong Kong’s autonomy, freedom of dissent and rule of law in the former British Crown Colony before the agreed date of 2048. Then there are accusations of theft of an estimated $5 trillion dollars of US Intellectual Property rights by the Xi-Ping Communist regime in Beijing.

There are Administration and Congressional proposals for bans on Federal Retirement System Chinese investments and possible suits for damages arising from the COVID-19 Pandemic. Note this from a Fox News Business report concerning a $1.6 trillion China debt swap proposal of the American Bondholders Foundation:

The administration is forging ahead with plans to divest $4 billion worth of equity stakes in Chinese companies held by the Federal Retirement Thrift Investment Board.

“There is almost no clean-cut tool that you can use to put pressure on China without hurting ourselves,” Xiaobo Lu, political science professor at Barnard College of Columbia University, told FOX Business.

Sens. Martha McSally, R-Ariz., Marsha Blackburn, R-Tenn. and Steve Daines, R-Mont., introduced the Stop China-Originated Viral Infectious Disease Act, which, if passed, would give Americans the right to sue China for the damage COVID-19 has caused to the economy and human life.

Another group of senators, led by Lindsey Graham, R-S.C., have introduced the COVID-19 Accountability Act, which would give Trump the authority to impose sanctions and travel bans, restrict loans to Chinese businesses by U.S. firms and ban Chinese companies from listing on U.S. stock exchanges.

A bipartisan US Senate bill co-sponsored by US. Senators John Kennedy (R-LA) and Chris Van Hollen (D-MD) was passed unanimously banning listing of Chinese companies on US exchanges and sent on to the House for rapid consideration. This action followed revelations of a $310 million revenue fraud by China’s Luckin coffee company facing de-listing by NASDAQ. A Wall Street Journal report on the new legislation noted:

At the heart of the dispute is China’s unwillingness to grant routine access to audit records sought by American regulators. Companies that sell shares publicly in the U.S. are legally required to be audited by firms that are inspected by the Public Company Accounting Oversight Board, an audit watchdog.

“All the rest of us want is for China to play by the rules,” Sen. John Kennedy (R., La.), who wrote the legislation with Sen. Chris Van Hollen (D., Md.), said Wednesday on the Senate floor. “This has gone on for years and years.”

In the meantime, Chinese companies like Baidu and Alibaba and dozens of smaller firms have raised over $66 Billion in initial public offerings on US Exchanges. Moreover, the Kennedy–Van Hollen Senate bill gives Chinese companies listed on US Exchanges a grace period of three years to comply.

This was the aftermath a 2013 Memorandum of Understanding reached between China and then Obama Vice President, now presumptive Democrat Candidate, Joe Biden exempting Chinese companies from transparent audits required by “the Public Company Accounting Oversight Board (PCAOB), a nonprofit regulator empowered by the Sarbanes-Oxley law to ensure U.S. investors are protected from making bad investments because of faulty audits or financial information.”

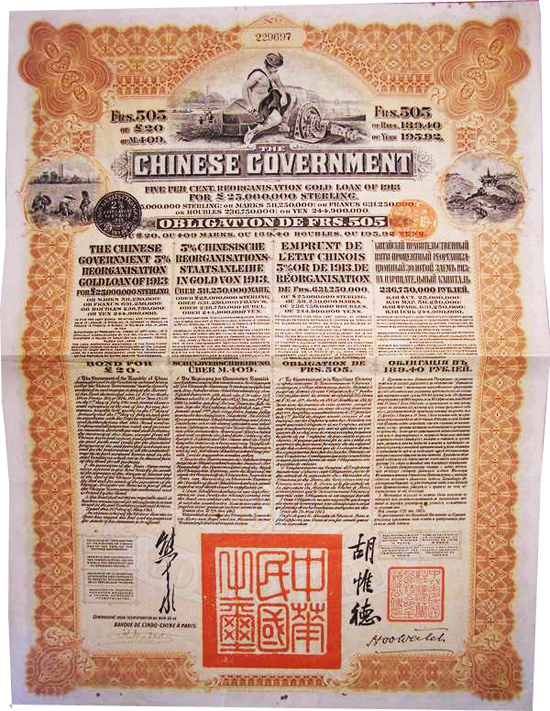

But there is a more practical solution; the swap of a century old gold backed bonds of the Republic of China that defaulted in 1938, valued at $1.6 trillion dollars, for a like amount of US debt held by China. The payoff could be billions of stimulus to the US economy at virtually no cost and a reduction in our national debt. This proposal is the work of a determined horse breeder and cattle rancher from middle Tennessee, Jonna Bianco, founder of the American Bondholders Foundation (ABF). It all started when she was approached by a US holder of these Republic of China bonds regarding a venture she was interested in. When she approached the US Department of The Treasury, she was told that they were genuine sovereign debt, but that China rejected the obligation as a successor regime in 1949 to pay off the debt. Over nearly two decades, working with the Bush, Obama and now Trump Administrations, Bianco has built an inventory of these legacy bonds from 20,000 Americans in 46 states, testified several times before Congress that in turn passed resolutions supporting the debt swap proposal. She briefed President Trump who told her, “the US pays its obligations and so should China.”

Bianco is channeling the late UK Prime Minister Dame Margaret Thatcher, who forced the Chinese government in 1987 to buy these defaulted ROC bonds, as a quid pro quo for accessing the global financial market in the City of London- the Wall Street of the UK. We have taken to calling her the American equivalent of ‘The Iron Lady,’ Margaret Thatcher.

US citizens are not alone in this quest to make China pay for these legitimate debt obligations estimated at over $6 trillion dollars as the successor government. Bianco points out citizens of France, Belgium, Italy and even Israel hold these China legacy bonds. Some of these groups have official standing from their governments, who have filed objections to China’s rejection of these legacy bonds with the WTO. Now with President Trump backing the China US debt swap, justice might be at hand. It is in large measure due to the groundwork of this determined woman who founded the American Bondholders Foundation, Jonna Bianco.

The research and experience of the ABF indicates regardless of which Administration is in the White House, legal roadblocks have thwarted consideration of the China bond swap proposal.

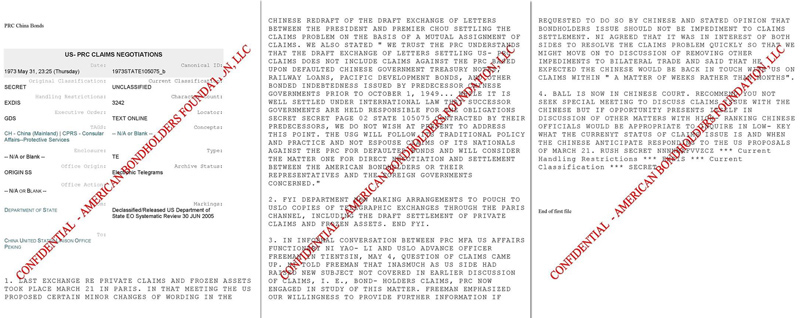

During the deliberations in the Carter Administration that resulted in the 1979 China-US treaty negotiated by the US Department of Justice Foreign Claims Settlement Commission, former US Secretary of State Henry Kissinger exchanged a cable with the Chinese Finance Ministry stating that it should not pay foreign claims on the defaulted Republic of China (ROK) bonds. Note this excerpt from a recently declassified State Department cable:

“WE TRUST THE PRC UNDERSTANDS THAT THE DRAFT EXCHANGE OF LETTERS SETTLING US- PRC CLAIMS DOES NOT INCLUDE CLAIMS AGAINST THE PRC BASED UPON DEFAULTED CHINESE GOVERNMENT TREASURY NOTES, RAILWAY LOANS, PACIFIC DEVELOPMENT BONDS, AND OTHER BONDED INDEBTEDNESS ISSUED BY PREDECESSOR CHINESE GOVERNMENTS PRIOR TO OCTOBER 1, 1949… WHILE IT IS WELL SETTLED UNDER INTERNATIONAL LAW THAT SUCCESSOR GOVERNMENTS ARE HELD RESPONSIBLE FOR THE OBLIGATIONS CONTRACTED BY THEIR PREDECESSORS, WE DO NOT WISH AT PRESENT TO ADDRESS THIS POINT. THE USG WILL FOLLOW ITS TRADITIONAL POLICY AND PRACTICE AND NOT ESPOUSE CLAIMS OF ITS NATIONALS AGAINST THE PRC FOR DEFAULTED BONDS AND WILL CONSIDER THE MATTER ONE FOR DIRECT NEGOTIATION AND SETTLEMENT BETWEEN THE AMERICAN BONDHOLDERS OR THEIR REPRESENTATIVES AND THE FOREIGN GOVERNMENTS CONCERNED.”

In 1979, when US bondholders of defaulted Republic of China debt filed a case against the People’s Republic of China (PRC) in the federal courts in the matter of Jackson v PRC, they won decisions, but were unable to collect payment because the PRC refused the claims on the grounds the former regime was illegitimate.

During the Reagan Administration, then Secretary of State George Schultz supported amicus filings that resulted in federal court decisions setting aside American bondholder federal cases under the US foreign sovereignty immunity doctrine.

When the ABF sought Bush Administration intervention in 2002 on behalf the US ROC bondholders the matter was referred to the State Department and the Foreign Bondholders Protection Council (FBPC) of the US Securities and Exchange Commission created in 1933 in an executive order by President Franklin D. Roosevelt. The FBPC had resolved more than 47 cases of defaulted foreign debt on behalf of US citizens. The proposed ROC bond swap would be the 48th such case.

During the Obama administration in 2012, former Republican California Congressman Gary Miller, writing in support of the ABF proposal ,received this reply from a US Department of the Treasury official that we reported in a New English Review, Iconoclast blog post, “Will China pay the $1 trillion it owes Americans?”

Undersecretary of The Treasury for International Affairs, Dr. Lael Brainard in a response dated May 11, 2012, focused largely on meetings held earlier that month in Beijing endeavoring to secure commitments from the PRC to open their financial sector to US banks and financial services firms.

Brainard attached a memo to Congressman Miller illustrative of how the Treasury views the pre-1949 Chinese debt default issue as a dead issue. The memo indicated that the Treasury Department does not hold any pre-1949 Chinese bonds in its foreign exchange reserves, nor, to its knowledge, does any other US government agency hold these bonds. Brainard’s memo indicates that it has no information on how many American citizens hold pre-1949 Chinese bonds. It categorically states that the US government has “no legal obligation to help bondholders seek and obtain settlement of defaulted bonds”. The memo goes on to note:

In 1970, the Foreign Claims Settlement Commission (FCSC), a quasi-judicial, independent agency within the Justice Department, considered a claim on defaulted pre-1949 Chinese Bonds under the International Claims Settlement Act of 1949. In FCSC Decision No. CN-47 dated March 18, 1970, the FCSC concluded that the bonds at issue had been in default since 1939 and the claims based on those bonds did not come under the purview of the Act, and accordingly denied the Claim.

Moreover, when queried by Congressman Miller about “whether the PRC has any obligation to satisfy these bonds, in whole or in part”, the Undersecretary’s answer was that “The Treasury Department has no view as to whether the current Chinese Government has any obligation to satisfy pre1949 bonds.”

Against this background, what follows is the Israel News Talk Radio—Beyond the Matrix interview with Jonna Bianco of ABF.

Rod Bryant: Welcome to Beyond the Matrix at Israel News Talk Radio. I am Rod Bryant along with Jerry Gordon. Jerry, please introduce our amazing guest. You both obviously have a history together.

Jerry Gordon: Yes, our history goes back nearly 15 years when I first encountered and wrote about Jonna Bianco, who I now call the Iron Lady of America. She admires her hero and model the late UK Prime Minister, Dame Margaret Thatcher. She is determined to correct a major imbalance in our country’s indebtedness with China. Jonna, tells us about what the American Bondholders Foundation is all about, who and what it represents.

Jonna Bianco: Good morning Saba, thank you so much for having me on. The American Bondholders Foundation was created in August of 2001 to represent individual citizens, every day average Americans, over 20,000 in 46 states, jointly and collectively to hold China accountable to pay their defaulted sovereign debt owed to Americans. We have worked tirelessly in trying to hold China accountable, with members of Congress, members of the Administration, both in the Bush administration throughout the Obama administration. There have been multiple resolutions out of the House and the Senate. This is a bipartisan, in fact, a non-partisan issue, that directly affects all of America.

Rod Bryant: How much does the People’s Republic of China owe the American Bondholders?

Jonna Bianco: Well, currently, the outstanding debt, if paid in full, would be approximately 1.6 trillion, dollars.

Jerry Gordon : What is the impact on the US if that was redeemed somehow?

Jonna Bianco: What we’ve asked the current Trump Administration to consider doing is to utilize these bonds to off-set against the $1.1 trillion debt that China has of US treasuries. Americans pay their bills, pay their taxes, those taxes go to pay interest as well as principal payments on Chinese held Treasuries. The law allows, at the direction of the President Trump, to utilize these bonds and pay China with their own paper, reducing our debt, infusing hundreds of millions of dollars into the hands of the everyday working-class American people. That is why we elected Donald J. Trump, to stand up and give a voice to those that have been forgotten, that had been walked on and run over by the Wall Street elites and Corporate America that sold us out to China long ago.

Rod Bryant: For the listener who is not familiar with how these bonds were issued why it is such an injustice? Would you explain that?

Jonna Bianco: As we all know, governments issue a treasury bond and people around the world buy that debt to help finance infrastructure and government overhead. From 1912 through 1938 what was then the Republic of China issued these bonds in good faith. Christian communities, churches, military personnel bought these bonds, to help support our then ally. The Communist regime, what we know today as the People’s Republic of China (PRC), came in, took over all of China, and ousted the Republic of China which fled into what we know today as Taiwan. Then the PRC refused to make good on these bonds. However, as we know, governments issue long-term debt – 20, 30, 40, 60-year bonds. In fact, I believe China is now issuing 100-year old bonds just like the US government does. However, in China’s mind, if it was issued by a former government, they are not responsible. They should not have to pay that, even though, as we sit here and speak, China is collecting the taxes that were used to underwrite all these bonds. As usual there is zero good faith coming from China.

Jerry Gordon: Jonna, have Americans tried to go to court here in the US to redeem these bonds?

Jonna Bianco: You are referring to the Jackson v PRC case. In the late ’70s, a group of bondholders filed suit against the People’s Republic of China, they got a judgment all the way up to the highest federal court level. In their attempts to collect on that judgment, the Minister of Finance in Beijing sent a scathing letter to the US Department of State during Secretary Schultz’s tenure in the Reagan Administration threatening economic hardships against US companies doing business over there if the US government didn’t get these bondholders under control. Secretary of State Schultz summoned a gentleman by the name of Davis Robinson to file an amicus brief to have the case set aside, not because of the merits of the case, because everybody acknowledges and admits China owes this debt. In the interest of national security, the court provided sovereign immunity protection for China. The case was set aside in US courts making it impossible for American bondholders to collect through our court system.

Jerry Gordon: What has been the history in the US of other sovereign debt that had been defaulted. What is this peculiar entity in the Securities and Exchange Commission that has resolved over four dozen cases?

Jonna Bianco: There is an entity called the Foreign Bondholders Protective Council that was established in 1933. Its sole purpose was to represent the American citizens seeking to collect defaulted foreign sovereign debt. There has been 47 previous bond settlements. Why? Because the US Government told those countries, “You owe a debt to our citizens and you need to pay it. We recommend you work with the Foreign Bondholders Protective Council’s good offices and resolve the issue.” We recently saw what happened with Argentina, when they were required to pay their defaulted sovereign debt. Look, successor government doctrine has been around for hundreds of years. It is no different than if US Treasury bonds that the US Government issues that were sold during the Bush administration. Does that mean that during the Obama Administration did not honor that debt issued by the Bush Administration? Well, of course we do. Bonds that were sold during the Obama administration, of course the US must honor that debt. The same goes for debt issued during the Trump administration. China has honored this Republic of China (ROC) debt previously issued. In 1987, my idol and hero, the late UK Prime Minister Dame Margaret Thatcher told China, “I’m sorry you’re not going to access our capital markets and take any more money from our people until you start paying what you currently owe.” China paid and accepted full responsibility for all ROC bonds issued, pre-1949 by “any other prior government and or territory thereof”. That is a quote from that settlement agreement of 1987. So, there is precedent. China has just not been told by the US, they must pay this debt.

Jerry Gordon: Jonna, why is it we have legislation pending in the Congress talking about imposing sanctions and also suing China under some form of sovereign jurisprudence to recover compensation for COVID-19 victims versus what we’re talking about, which is a giant debt swap?

Jonna Bianco: While I commend Members of Congress, both House and Senate, for filing legislation in good faith to try to make a difference, as we know, China is currently protected under Foreign Sovereign Immunity in the courts as a result of the Jackson versus PRC case in the late 70s. You can have judgments all day long just as they did in the Jackson versus PRC case against China or a sovereign government. However, if you do not have an administration willing to stand up and enforce that judgement, well then, it is all for nothing. That is what I see taking place now, that has taken place in the past. I believe that there will be a significant difference under President Donald J. Trump because he has made it clear he does intend to hold China accountable.

Jerry Gordon: Who in the administration is the point-person for getting this done?

Jonna Bianco: Obviously, the President and others he appoints and serves under his leadership. We were very blessed following our meeting with President Trump. He personally reached out to Secretary Mnuchin and asked him to meet with us to brief him on the importance of this issue, and the difference that this issue would make across America. At the time, Secretary Mnuchin, was in the middle of the Phase One China Trade Deal, and he had 150 things on his plate. Unfortunately, we were not one of them at the time, but things have changed. We can achieve this debt offset without having new legislation passed in the Congress because the laws are already there to accomplish this. It is a matter of the President saying, “Enough is enough. China, we are holding you accountable to play by the very same rules that we, as Americans, and the rest of the world play by,” and giving directives to uphold this debt and do a debt swap.

Jonna Bianco: Obviously, the President and others he appoints and serves under his leadership. We were very blessed following our meeting with President Trump. He personally reached out to Secretary Mnuchin and asked him to meet with us to brief him on the importance of this issue, and the difference that this issue would make across America. At the time, Secretary Mnuchin, was in the middle of the Phase One China Trade Deal, and he had 150 things on his plate. Unfortunately, we were not one of them at the time, but things have changed. We can achieve this debt offset without having new legislation passed in the Congress because the laws are already there to accomplish this. It is a matter of the President saying, “Enough is enough. China, we are holding you accountable to play by the very same rules that we, as Americans, and the rest of the world play by,” and giving directives to uphold this debt and do a debt swap.

Rod Bryant: Besides the example of the UK selective default negotiations with the PRC, can you give any other examples of successful governments paying off a prior regime debt?

Jonna Bianco: Germany is still been paying off the Weimar debt. We have the French Bondholder group that I referenced previously that was responsible for getting Russia to pay the Czarist-era debt to France. Britain, I believe last year, sent a payment on loans from the US during World War II. Successor governments do pay their debts, and we expect China to do the same. However, they will not unless forced to as we saw in the 1987 China-Britain Treaty under the late UK Prime Minister Dame Margaret Thatcher.

Rod Bryant: I really see that the dangling the carrot of debt swap would be an exceptionally good one to go with.

Jonna Bianco; I do believe It should be done. I can assure you that if the roles were reversed and this was a debt that the US owed China, China would have already stepped in, taken airports, railways, ports, infrastructure, just as we’ve seen around the world, especially in the African region, with over $140 billion in defaulted loans, in Sri Lanka, and other places. We see the moves that they are trying to make in Israel, which is very frightening, as they have infiltrated, and they dangle their money. They pay corrupt politicians, and it falls on the backs of the everyday person in those countries. And it is a profoundly serious national security issue.

Currently, China has unfettered access, along with all their state-owned enterprises, to the US capital markets. There is no disclosure. There is nothing.

Rod Bryant: Think about the farmlands, the infrastructure, the properties that are owned by China in the US and elsewhere. I really believe if most people knew how much they were invested in other countries, it would probably scare them to death.

Jonna Bryant: I have no doubt. It scares me to death every day just knowing what they have here in the United States of America some of our most important infrastructure that they own and control. Take as one example the Chinese purchase of Smithfield Foods, the largest pork producer in our country. That is part of our food supply chain. We now have a foreign government who has made it clear their intentions against the United States and the rest of the world. It is very frightening to know that it is under the control of the Chinese Communist Party.

Rod Bryant: Think about this. The ports that they may manage and operate in Israel like Haifa that the US Navy Sixth Fleet uses to home port. Jerry, what else do you know?

Jerry Gordon: That was one of the reasons why Secretary of State Pompeo took time out of his busy schedule to fly to Israel to talk to Prime Minster Netanyahu just before the formation of the new government and expressed concerns about not only the contract for the management of the Port of Haifa, but also the potential award to Hutchison Water Company of Hong Kong for the largest desalination project that Israel has undertaken. On top of that, you have significant Chinese minority investment in Israeli high tech. Thus, China’s investments and control of these projects creates a national security issue for not only Israel, but it also threatens the special alliance between Israel and the US. Jonna, switching back to the US, how non-partisan is this issue?

Jonna Bianco: We have been truly fortunate since our creation in this regard. This issue is bipartisan supported in the House and Senate. There have been multiple resolutions issued. I have testified before Congress on two occasions, the World Bank, IMF, held special luncheons and conferences on this issue in support of China being held accountable, in support of doing debt offset structures around the world. The World Bank tried their best to get members and countries in Africa to purchase this debt from us discounted and use it at full value to extinguish what they owed to China to prevent from losing their infrastructure—the ports, the railroads, and properties. People are afraid of China. Wall Street and corporate America are afraid of China. They are fearful should they support this issue or anything anti-China, their factories will be burned to the ground. We have already seen the $5 trillion of intellectual property theft from China. The parade of horribles is unbelievable. Better to turn a blind eye in hopes that over time China changes, which we have seen it will not. Their intention is clear. We have seen over time that corporate America and Wall Street are now realizing that getting in bed with the Chinese was not necessarily in their best interest or America’s.

Rod Bryant: I realize you are not a prophet. However, what would be the impact of the debt swap on the international and the US economy?

Jonna Bianco: You are talking of trillions of dollars that China owes in defaulted sovereign debt around the globe, not just here in America. However, if this was done via a debt offset, you are talking about infusing billions of dollars into the US economy as well as reducing our national debt. I think it would make a significant difference in the lives of Americans as well as those around the globe to hold China accountable and push back against their tyranny.

Rod Bryant: It would be a shot in the arm after going through this COVID pandemic seeing the economy just spiraling downward. This would be an amazing boom. Now, who knows how long it is going to take to get China to put that money back in the coffers or trade the debt? If it could be done quicker, it would be so much better. Do you have anything on that?

Jonna Bianco: There’s no reason it cannot be done. It will be 19 years this August since the American Bondholders Foundation was founded. In the very beginning, the bondholders decided they wanted to help make a difference in America. They knew this was going to be a heavy lift. They knew this was going to be like a David versus Goliath story, which it truly has been. However, they wanted to help make a difference for all of America. So, under contract, they attributed 20% of every penny collected would go to an already approved 501c3 non-profit called ABF charities. Its purpose, coming out of the gate, is to provide members of our first line of defense: for example, volunteer firefighters in America. There are over a million. These are people who put their life on the line, not because they get paid, but because they are patriots, and they care. They do not even have proper turnout gear and breathing apparatus. These funds will go to provide that across this country. That is one example of many that will make a difference in America.

Rod Bryant: What would be the impact of cashing in those bonds not only for American citizens, but Israeli citizens, and others around the world holding these defaulted China bonds. This is not just something benefitting the United States, correct?

Jonna Bryant: That is correct. Just as we have the American Bondholders Foundation here in the US representing citizens holding this defaulted paper, in France, you have the GNDPTA, officially recognized by the French Government. In fact, the French bondholder group filed a formal WTO complaint against China on these bonds. They were responsible for getting Russia to pay pre-Soviet era Czarist debt. Germany has honored debt issued by the Weimar Republic. The UK is continuing to pay on Lend Lease loans issued during WWII in 1940. So, there is precedent for Governments to pay their debts of prior governments. China needs to be held to play by the same rules as everybody else and they need to be denied unfettered access that they currently have to US capital markets taking trillions of dollars from investors and then defaulting.

Rod Bryant: What do you think of the chance of this actually going through and having the President sign this request?

Jonna Bianco: I was very honored to meet with President Trump. We had a serious conversation. He took this issue seriously. President Trump made clear, he intends to hold China accountable to play by the same rules, when he said he expects reciprocity. “Americans pay their bills and China needs to do the same.” So, we feel confident. That’s why we elected Donald J. Trump, to stand up for the everyday average Americans whose voice has been lost.

Jerry Gordon: What is the mystery behind the US Government holdings of these Republic of China bonds?

Jonna Bianco: I look forward to talking about that. There was a time when bipartisan Members of Congress wrote letters to the US Treasury inquiring if they held any of these defaulted sovereign bonds. The US Treasury has officially come back and said no, they do not. So time will tell.

Rod Bryant: That would be interesting to find out that we could actually put that back into the national debt.

Jonna Bianco: Right.

Rod Bryant: But we don’t know that right at this point.

Jonna Bianco: My job is to represent the citizens that hold this paper that have not had a voice. My number one priority is to get justice for the 20,000 plus American citizens in 46 states who are holding this defaulted Chinese sovereign debt and to work hand-in-hand with those around the globe in Israel, Belgium, France, Italy, Australia and Japan who hold this debt to collect it.

Rod Bryant: Is it really going to require each one of these nations, from Israel to United States and France, to put pressure on China. This is not something that an individual can do, correct?

Jonna Bianco: Correct. We have no voice against China. We have served them notice; they just put it in a trash-bin somewhere. They get ignored. China takes money from people, bullies them, and threaten not to pay it back.

Jerry Gordon: Jonna, I would like to start at the beginning. How did you, as a woman living in middle Tennessee, raising horses and cattle get involved with an international financial debacle?

Jonna Bianco: To be honest, I was seeking venture capital for another project, a seat belt invention. An older gentleman gave me a couple of these bonds. I had no idea what they were. At the request of my attorney I sent them for forensics to the US Department of the Treasury. The Treasury Department came back and told us “Yes, they’re legitimate, they’re real, they’re credible, they’re authentic.” I’m like, “Great. Where do I go to collect it?” And I said, “You’re telling me this is no different than a US Treasury Bond.” And they said, “Well, China doesn’t want to pay.” I said, “I don’t understand. What do you mean? This is a government sovereign bond.” “Well, it’s complicated. China doesn’t want to pay.” I was infuriated by that because there was nowhere to go. I could not go to a bank. I could not go to a Wall Street firm. I could not go anywhere to collect this debt that China owed. At the time, I had no idea how many people, not only in America, but around the world were holding this paper. I began to research and work on it. It became my life’s mission that China was going to play by the same rules and be held accountable. Our country was founded on justice, the law and fairness. As far as I was concerned, China was going to play by the same rules if they were going to continue to do business in America. I live on a farm and I have a dirt, gravel driveway. At the end, I have a gate, so my livestock if they get out, do not get out on the road. Every day I woke up to find packages from around the world with bonds and letters from people saying, “Please, will you represent me?” My grandfather passed these Chinese bonds down to 36 grandchildren. He bought them because he was in the war in our military. They were promoted to our military personnel to help support our then-ally China in WWII. I have had churches contact me. These churches have members who purchased these bonds. These are bonds that have been passed down to children and grandchildren in hopes that someday they would receive justice and their investment would be returned.

Rod Bryant: When you think of $1.6 trillion. It is hard to even imagine. I know that when we listen to Congress talk, they throw a trillion around like we would throw a $100 bill around, right? It is just another trillion. What is another trillion? What you are saying is this would be a genuine boom for our economy with people getting money back for their families that they wished and hoped for. It is like holding counterfeit money.

Jonna Bianco: That is correct. At the end of the day, we have the master negotiator sitting in the White House. I am confident that he will look out after the best interest of the American people. He will negotiate a resolution. My job is to give him as much flexibility and leverage as possible to hold China accountable. That is my goal and objective. We feel confident that the master negotiator will do right by the American people and the bond holders.

Rod Bryant: What do you say to those listeners who find that they have these defaulted bonds, what can they do to get their voices heard? Is there a registry?

Jonna Bianco: Currently, the bonds that the ABF represents, we have physical custody of those bonds. We have not taken bonds in for years. However, they can contact our parent company Azucena Enterprises and get representation should they want to get those bonds collected. That stands for anybody around the world that have these bonds. The website for Azucena is azucenaenterprises.com with instructions. We plan to be a voice for everyone who have been forgotten and not obtained representation.

Rod Bryant: What can the average person do to help promote this? What can we do to fan the flames?

Jonna Bianco: The American people need to pick up their phone and call their Congressman, their Senators, and say, “Hold China accountable. And stop playing around. And quit dragging things on and on.” After 20 years with the American Bondholders Foundation, it is time for justice to prevail. It is time that members of Congress tell the President, “We support you in holding China accountable and play by the very same rules.” That is what the American people need to do. Or they can call the White House and say, “Mr. President, we support you holding China accountable.” It is bad enough that they have stolen so much of our intellectual property. Now they are trying to steal vaccine information.

As we have seen, the CCP are liars, they cheat, they are thieves. It is time that they are called to the table. It is time that they are held accountable. The American people can voice that to the President at the White House and their members of Congress. Enough is enough.

Rod Bryant This is actually a really good time for us to bring this up, because of COVID, there are a lot of individuals who are having to rethink their own personal opinions about how we need to wean ourselves from China. There are individuals out there that are realizing, “You know what, we have been spoiled by this, and we need the business back in our country. We need factories, we need all the production back in our country that we haven’t had for years.” All because China was willing to step up and do it, we just let it go. How can an individual contact you personally and are you available to chat with someone?

Jonna Bianco Certainly I am. I try to make myself available to everyone. This is an especially important American issue. We have a website: AmericanBondholdersFoundation.com. All our contact information is on that website. We have Twitter @ABFUSA, and you can follow us on Facebook. We welcome all the support we can get. It is time for America to take a stand and bring our pharmaceuticals back to be manufactured in America, and stop the CCP from terrorizing the world as we have seen.

Jerry Gordon: One of the issues that you addressed earlier, in fact, I think Rod brought it up, was that perhaps unbeknownst to the general public, China has acquired vast acreage in the Permian Basin for production of oil. I point to a recent report that there was a fleet of 107 large tankers with cheap oil being shipped across the Pacific to China. As you pointed out, the WH Group of China owns America’s largest pork producer, Smithfield Foods, Inc.—whose South Dakota packing plant is one of the ‘hot spots’ in the COVID-19 Pandemic in the US. What do we do about these cases? Is this the punishment that the free market has for us in the context of retaining our national provenance? I would like you to address that.

Jonna Bianco: Well, it goes back to the 1979 Foreign Claims Settlement Commission under Kissinger, when he basically sold out the bondholders, opened normal trade relations with China. We saw China move into the WTO to be the superpower that they are today all for the benefit of Wall Street, corporate America. They wanted access to that 1.4 billion population to do business in China. The American people are so busy keeping up with the Joneses, that they were not keeping their eyes on what was really going on in their country that we have been taken over from within by the Chinese Communist Party. It is going to be difficult to start turning that back, but if we do not, we might as well all start speaking Chinese. I think the American people have awakened. I think that is why we elected Donald J Trump to stand up for America to make America first and to start pushing back against the Chinese Communist Party and what they’re doing to our country.

Rod Bryant: Because of the growth of capitalism around the world, even in Communist countries, they have been testing it and playing with the idea. There is now a full-court press of economic warfare that most people have ignored. China has been in the forefront of that for years. I can remember stories of Russian scientists touring the Army Redstone Arsenal or NASA. They would pick up on their shoes metal. They would analyze and find out what were the properties of such materials. They may have been doing this for decades.

Jonna Bianco: Decades, absolutely.

Rod Bryant: And it’s time that we call it.

Jonna Bianco: Yes, China has infiltrated every phase of our government, city, county, state, and federal. And it is time we start pushing back. I mean, look at their students who come here and attend our colleges and universities. Their task is to obtain information and report back to the CCP. Enough is enough. We better fight to take our country back.

Rod Bryant: Absolutely.

Jonna Bianco: And now is the time.

Rod Bryant: We mentioned the fact that they own billions of dollars’ worth of infrastructure in this country. If they wanted to and had the desire to do it, they could put a serious crunch on our country. I do not think people realize that.

Jonna Banco: They already have by manufacturing much of our pharmaceutical supplies. 95%, even our Tylenols, our diabetes, heart, and high blood pressure medicine comes from China. It needs to be brought back to the US.

Rod Bryant: Well, this has been a fantastic interview. We really appreciate you coming on the show.

Jonna Bianco: Thank you.

Listen to the Israel News Talk Radio-Beyond the Matrix interview with Jonna Bianco of the ABF.

Watch the NetivOnline YouTube video of the Israel News Talk Radio—Beyond the Matrix interview.

«Previous Article Table of Contents Next Article»

____________________________

Jerome B Gordon is a Senior Vice President of the New English Review, author of The West Speaks, NER Press 2012, and co-author of Genocide in Sudan: Caliphate Threatens Africa and the World, JAD Publishing, 2017. Mr. Gordon is a former US Army intelligence officer who served during the Viet Nam era. He is producer and co-host of Israel News Talk Radio—Beyond the Matrix. He was the co-host and co-producer of weekly The Lisa Benson Show for National Security that aired out of KKNT960 in Phoenix Arizona from 2013 to 2016 and co-host and co-producer of the Middle East Round Table periodic series on 1330amWEBY, Northwest Florida Talk Radio, Pensacola, Florida from 2007 to 2017.

Rod Reuven Dovid Bryant is creator and host of Israel News Talk Radio—Beyond the Matrix.

Follow NER on Twitter @NERIconoclast