By Conrad Black

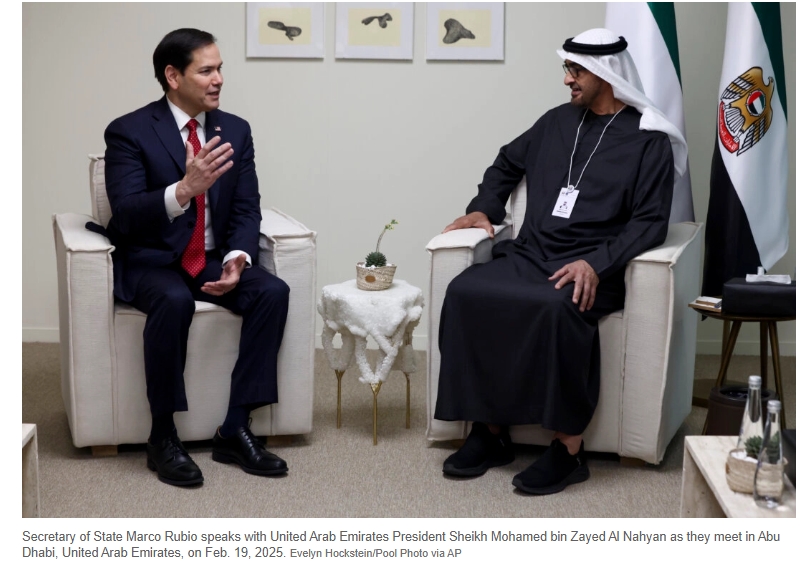

The announcement by the United Arab Emirates that it is investing $1.4 trillion in the United States will highlight the efforts that President Trump has launched to attract investment, create jobs, and return to the United States, under threat of tariffs, many commercial functions that have already departed or would otherwise be conducted elsewhere and exported to America.

As was partially outlined in this column last week, despite the helter-skelter appearance of some of the president’s initiatives as they tumble out, there is a discernible and comprehensive effort to accelerate investment and economic activity, patriate industry, and reduce taxes, while increasing some defense expenditures. Spending and revenue always balance in some way, even if the balance, whether in the public or the private sector, is achieved by unusual quantities of borrowing. Trump has given extensive lip service to concern about the expansion of the federal debt to over $36 trillion, approximately 122 percent of American GDP of almost $29 trillion. It should be noted that the U.S. GDP is more than 150 percent of that of China, which was almost universally touted to be on the verge of surpassing the United States as the world’s greatest economy 10 years ago.

As was partially outlined in this column last week, despite the helter-skelter appearance of some of the president’s initiatives as they tumble out, there is a discernible and comprehensive effort to accelerate investment and economic activity, patriate industry, and reduce taxes, while increasing some defense expenditures. Spending and revenue always balance in some way, even if the balance, whether in the public or the private sector, is achieved by unusual quantities of borrowing. Trump has given extensive lip service to concern about the expansion of the federal debt to over $36 trillion, approximately 122 percent of American GDP of almost $29 trillion. It should be noted that the U.S. GDP is more than 150 percent of that of China, which was almost universally touted to be on the verge of surpassing the United States as the world’s greatest economy 10 years ago.

President Trump has said that he will not touch entitlements, which almost all informed people believe will ultimately be necessary to put the U.S. fiscal house in order. He is concentrating his efforts to reduce the annual federal deficit on enticement of more foreign investment, the creation of a greater spirit of commercial optimism within the United States (which will itself increase productive investment and job creation), reduction of government expenditures by up to $1 trillion (which most observers think to be somewhat optimistic), as well as what he has apparently convinced himself is a potential bonanza in federal revenue from the imposition of reciprocal tariffs on all of the countries of the world. <div

Since this is such an unorthodox program, there is not much in the way of worthwhile comparisons to assist in predicting what level of success it might enjoy. But one ingredient of his program that does appear to be off to a swift start is the attraction of foreign investment. To those who think that the U.S. economy has any resemblance to a zero-sum game, there is great skepticism about whether the United States can avoid a recession in the near term and whether any progress can be made on the federal deficit given the promises Trump has made to retain and amplify tax cuts. They generally hold that there is only $700 billion of discretionary spending in the U.S. federal budget and that accordingly, the target of a trillion dollars of savings is at least three or four times as great as what can actually be achieved.

Those who express these reservations also claim that no matter what level of supplementary foreign investment is attracted to the United States under this administration, traditional theories of resulting job creation, income growth, and increased tax revenue are obsolete because no significant amount of new foreign investment will fail to account for artificial intelligence, robotics, and other advanced methods of scientific mechanization of work.

It is assumed—generally on the basis of fundamental skepticism rather than serious case-by-case analysis of large investment projects—that any influx of increased foreign capital being deployed in the United States will be in pursuit of high-income return through capitalization on industries that are not labor-intensive. This is supposition; some lucrative activities do require a lot of warm bodies and there is no reason to doubt that investment, foreign and domestic, that maintain such levels of employment will be among the projects that attract new capital.

This administration has already taken aim at the fact that American higher education now graduates every year millions of people who have no possibility of earning an income from the subject which they have principally studied.

As Jordan Peterson has remarked, no area of endeavor describing itself as “studies” is an authentic academic subject. Geography, history, every language and literature, chemistry, and all the traditional sciences and subdivisions of mathematics, as well as the arts, have been recognized as genuine academic subjects since time immemorial. But no one will be able to make a living from an undergraduate degree in gender studies or even environmental studies. To a large extent, the American university, as in other Western countries, is an unemployment deferral scheme but not a cure for unemployment.

There is no reason to doubt at this point that the combination of tariffs, tax reductions, university reform, and attraction of increased foreign and domestic investment will reduce the federal deficit, increase economic activity and general prosperity, and alleviate unemployment and pseudo-academic underemployment. Nobody knows for sure, and it is all to play for, but Trump’s track record on the economy is very strong.

First published in the Epoch Times

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link